Employer Sponsored Retirement and Benefit Programs

We provide solutions for the changing retirement world - walking together through the maze of choices and decisions.

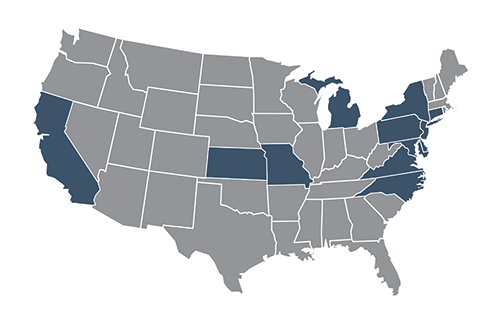

We Serve Clients Nationwide |

|

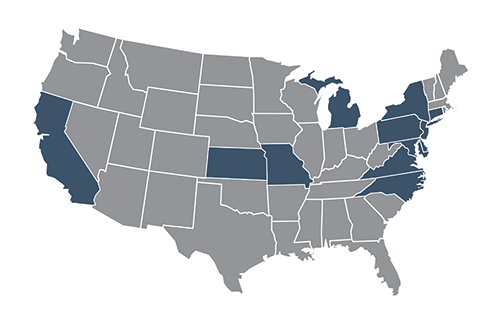

We Serve Clients Nationwide |

|